Corporate Citizenship

The Rhodes Scholarships for singapore 2025

RHODES-APS SINGAPORE ANNUAL DINNER & ADDRESS 2023

Rhodes-APS Singapore Annual Dinner & Address 2022

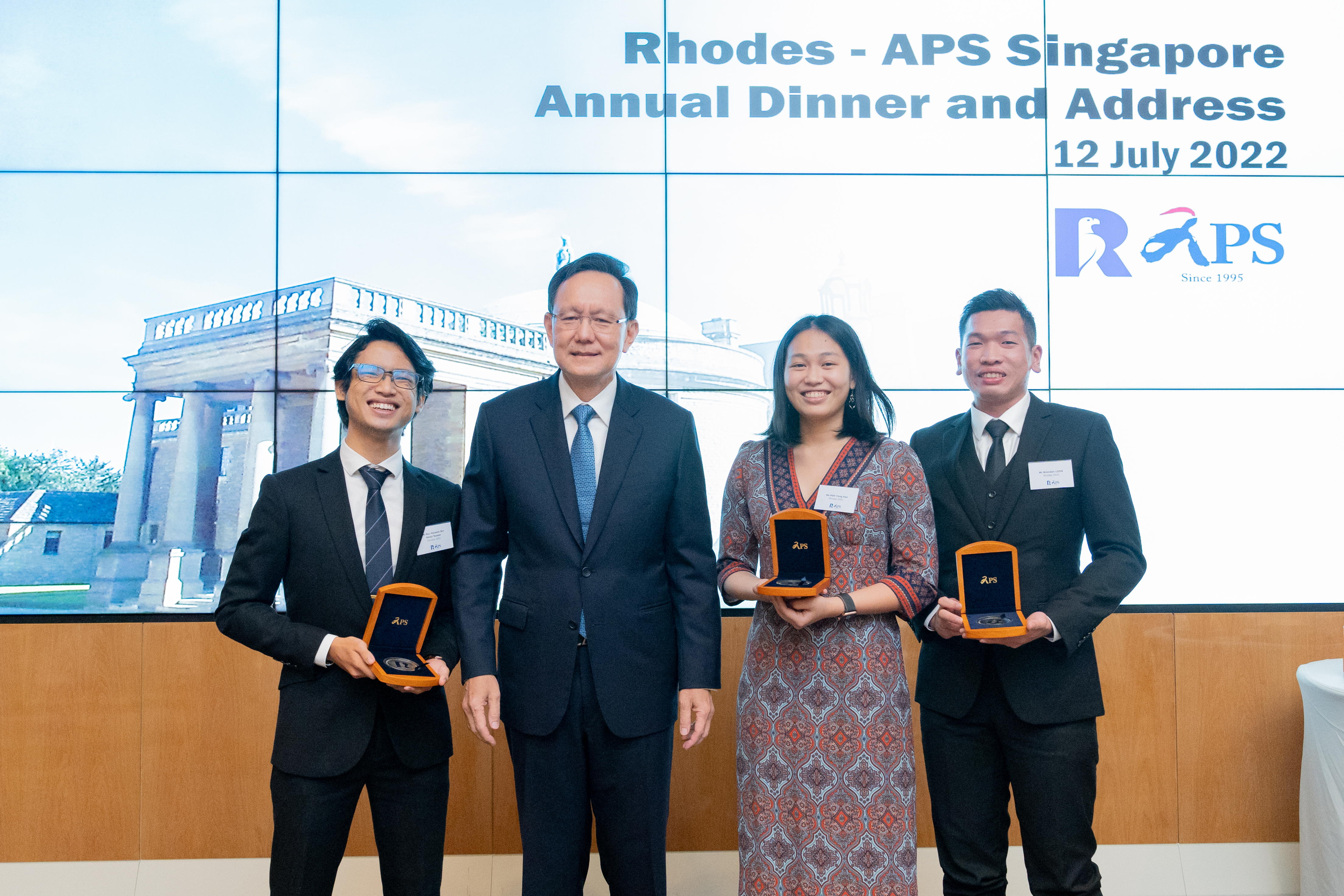

The Rhodes-APS Annual Dinner and Address was held on 12 July 2022.

This is the annual flagship event of the Rhodes community in Singapore where a prominent speaker is invited to give the Address and where the latest Rhodes Scholar is welcomed to the Rhodes family. This year’s speaker was Dr Elizabeth Kiss, Warden of Rhodes House who is the first woman Warden in its history. The latest scholar is Nur Hazeem Bin Abdul Nasser (https://str.sg/3GJ9) the first Malay-Muslim Rhodes Scholar in Singapore. The Rhodes Scholarship is the preeminent international scholarship programme for young men and women whom the Trust hopes would be future leaders in their community. It was for this reason that APS Asset Management was delighted to be able to work in partnership with the Rhodes Trust to reinstate the scholarship in 2018.

APS Chairman Raymond Lim who is himself a Rhodes Scholar with the Rhodes-APS Scholars at the Annual Dinner & Address on 12 July 2022. From L: Nur Hazeem bin Abdul Nasser (2022), Raymond Lim, Poh Yong Han (2021) and Brendan Loon (2020). APS helped reinstate the Rhodes Scholarship for Singapore in 2018.

Dr Elizabeth Kiss, the Warden of Rhodes House giving the Rhodes-APS Singapore Annual Address 2022 - “The Power of the Unlike-Minded: Reflections on Leadership in a Fractured World”.

Nurturing the next generation of investment talent in China

|

| APS passes on an investment approach based on investigative research, rigorous valuation and a long-term view |

| “The practice is the most valuable part of the project - how to investigate a company, how to perform an expert call, how to communicate with sell-side analysts, how to get useful information from them. This process taught me how top professionals in the industry do equity research. Another valuable experience was the teamwork, which was necessary for completing our assignment efficiently. I highly treasure the work ethic APS demonstrated. You taught me that diligence, humility, and curiosity are the key elements of an outstanding research analyst.” | |

| He Ji, from Anqing, Anhui Province | |

| “The way to value a company represents the depth of understanding of the industry. Take for example [one of the largest Chinese ecommerce companies]. We learned to split it into three main businesses: retail, logistics and financial services, and value them separately. This broadened our perspective and gave us deeper insights into evaluating the company’s future. I believe this kind of thinking would benefit us a lot in our future investment career.” | |

| Li Sheng, from Shanghai | |

| “I learned to decompose a company's business and cross check every information source. But the most important lesson is a value-oriented investing philosophy.” | |

| Zhou Yiran, from Huai’ an City, Jiangsu Province | |

| “I had a wonderful experience with APS and came away thinking that investment may be more an art than a science. The most valuable things I learned include organizing a large volume of data into an investment idea or thesis and updating that thesis over time.” | |

| Qian Zhongwei, from Taizhou, Jiangsu province | |

| “Before participating in the project, I only knew APS as an outstanding QFII. Through the project, I gained an impressive view of APS’ culture. The staff are very nice. Chris Tan, Wong Kok Hoi, and Wang Kangning have very solid investment knowledge and gave the team a lot of useful suggestions. I think APS is a very good choice for someone pursuing a career in equity research and investment.” | |

| Jason Chen, from Hefei, Anhui Province |