- Business Units

-

- Fund Prices

- Contact Us

- Home

- About Us

- 30th Anniversary

- Investment Approach

Investment Philosophy & Process Investment Strategies Alpha Groups - Thought Leaders

APS China Monthly Notes from the CIO Live, Breathe, and Talk China APS Insights Show Me the Fundamentals Presentations & Discussions Download Center - APS Events

APS Annual Client Event 16th Annual Client Event 2019 5th Annual APS Asia Forum (New York) 2019 APS Asia Forum (London) 2019 18th APS China Client Event 2024 17th APS China Client Event 2023 15th Annual Client Event 2018 APS Asia Forum (London) 2018 14th Annual Client Event 2017 APS New York Investment Conference 2017 Pictures from previous Client Events Videos from previous Client Events 13th Annual Client Event 2016 APS New York Investment Conference 2016 Inaugural APS London Investment Conference 2017 30th Anniversary and 19th Annual Client Event 2025 Annual Client Event 2015 Previous Events 13th Annual Client Event 2016 - Fund Prices

Fund Prices Long Only Strategies China A Share Asia incl. Japan Asia ex-Japan Japan Vietnam All China Long/Short Strategies Asia Including Japan All China Fund Financial Statements - Asian Portfolio Specialists Funds VCC

ACSEAN Capital - APS

Google Map Search Results Testing Accounts Sidebar RWD Sitemap APS Protected Page Important Information - Thought Leaders (OLD)

Notes from the cio (old) APS Insights (OLD) Show Me The Fundamentals (old) Thought Papers (oLD) Presentations and Discussions (OLD) - Investment Approach (OLD)

Investment Philosophy Investment Process Alpha Groups (old) - APS Fund Information and Services

- Home

- About Us

The APS Covenant History & Milestones Board of Directors & Key Executives Wong Kok Hoi Dr Tan Kong Yam Wang Kangning Stella Zhang Lu Lan Fang Anson Li APS in the News Corporate Citizenship & Culture Corporate Citizenship Corporate Culture Offices & Contacts - 30th Anniversary

- Investment Approach

Investment Philosophy & Process Investment Strategies Alpha Groups - Thought Leaders

APS China Monthly Notes from the CIO Live, Breathe, and Talk China APS Insights Show Me the Fundamentals Presentations & Discussions Download Center - APS Events

APS Annual Client Event Pictures from previous Client Events Videos from previous Client Events 30th Anniversary and 19th Annual Client Event 2025 - Fund Prices

Fund Prices

Home >

Investment Approach >

Investment Philosophy & Process

Investment Philosophy & Process

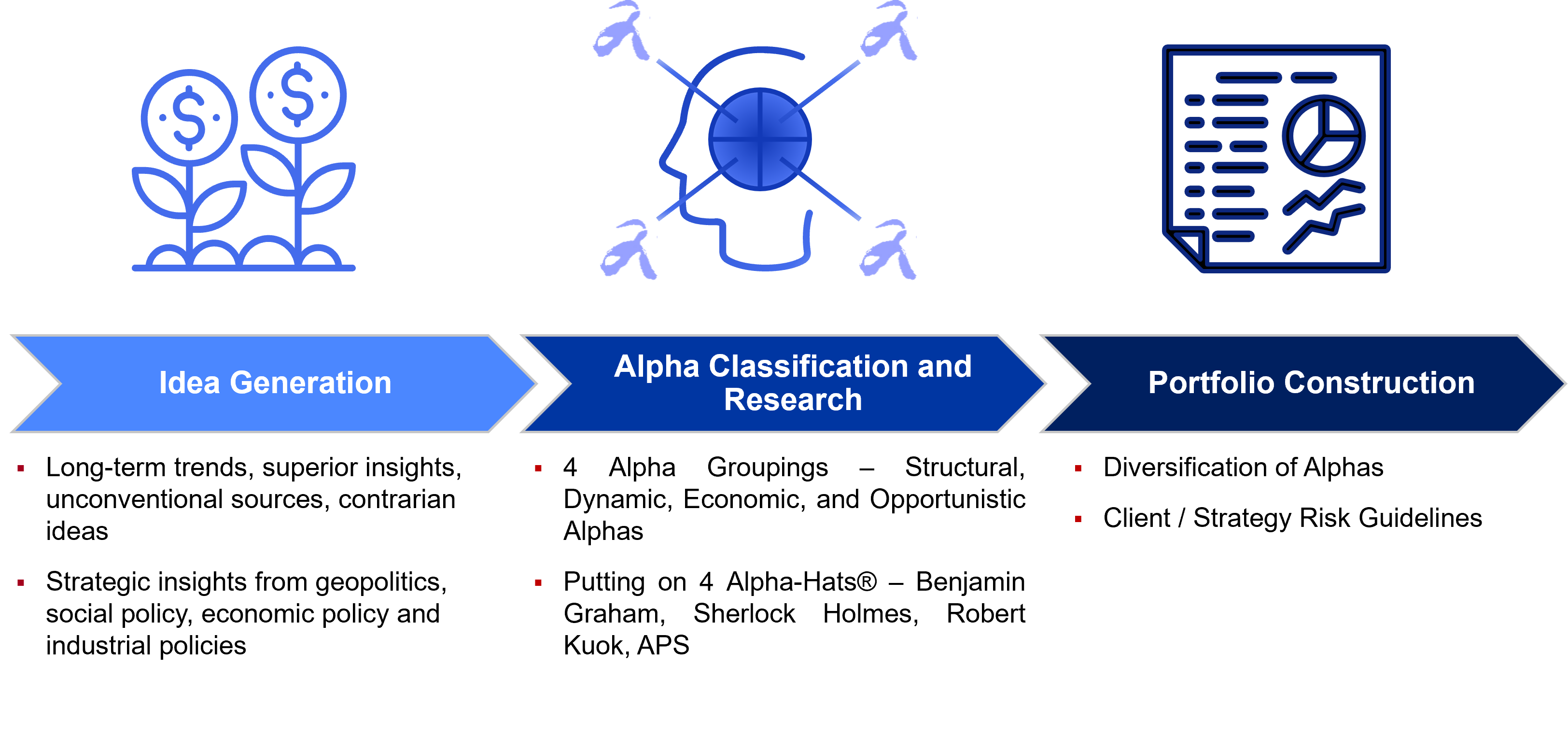

Our Edge – The APS Four Alpha-Hats® Investment Process

Benjamin Graham Hat

APS conducts thorough financial analysis and valuation work, which every serious investor would do.

Sherlock Holmes Hat

APS conducts forensic accounting analysis and investigative research into company founders, CEOs, CFOs, claimed technologies, and core competencies, searching for any suspicious items.

Businessman (Robert Kuok) Hat

APS assesses companies through the lens of a savvy businessman, rather than from a purely financial analysis standpoint.

The APS Hat

APS believes a portfolio constructed with four types of alphas — Structural, Economic, Dynamic, and Opportunistic — would outperform the market in most economic and market conditions.

For your protection, please do not share any confidential information, personal data or provide transactional instructions in your enquiries or feedback. APS does not accept and act on orders or instructions sent by e-mail

Copyright © 2009-2025, APS Asset Management Pte. Ltd. Company Registration Number; 1980-00835-G. All rights reserved